cryptocurrency tax calculator india

This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. This section levies a 30 tax plus applicable surcharge and 4 cess on profits made by trading.

10 Best Crypto Tax Software Apps 2022

If you are an Indian taxpayer and have transacted with cryptocurrency during 2021 or 2022 you need to calculate the realized gains.

. Calculate Income Tax TDS GST on Cryptos for investing andor trading Cryptos like Bitcoin Ethereum XRP. There are cloud-hosting tools specifically designed for crypto miners. This means you can get your books.

Once youre done importing you can generate a comprehensive crypto tax. How to calculate crypto taxes in India. Taxation on cryptocurrency in india.

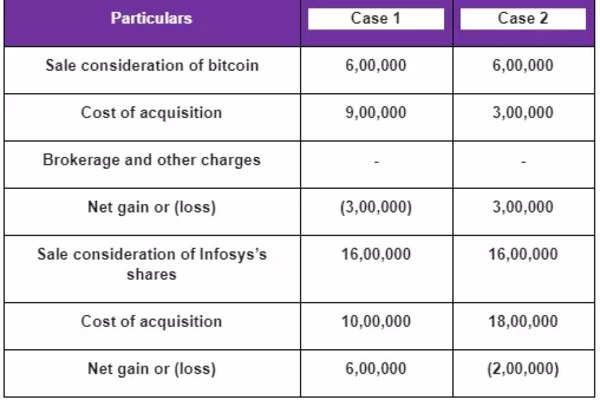

To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. UK If you are a basic rate taxpayer you will have to pay 10 tax on cryptocurrency transactions. Tax calculator income tax.

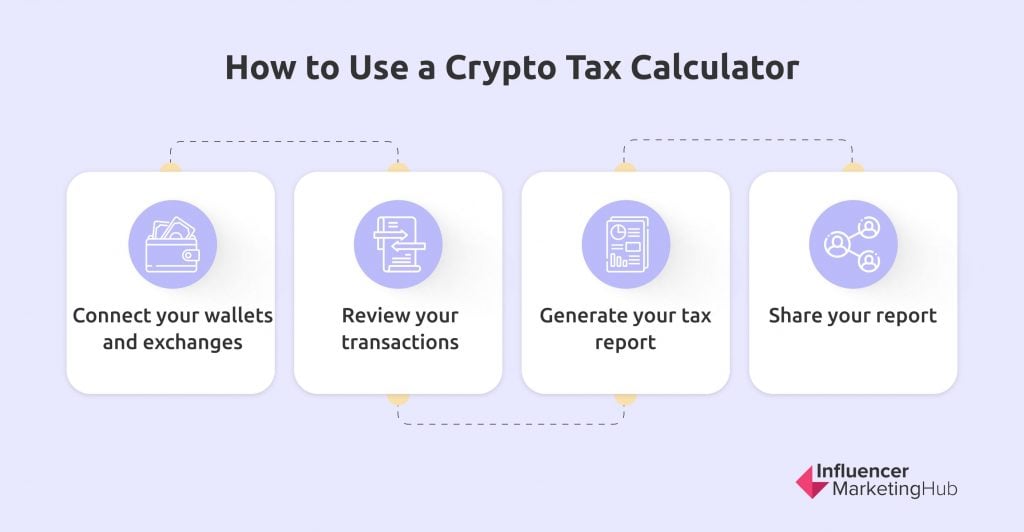

Rules for Tax on Cryptocurrency in India. You simply import all your transaction history and export your report. Crypto Tax Calculator India Income Tax Calculation on Cryptocurrencies NFT EXPLAINED Bitcoin Ethereum with tips and all queries solvedIn this video by.

Determines income tax surcharge education cess and GST based. From the 1st of April 2022 According to the amendments to the Finance Bill of 2022 which was presented among the Lok Sabha members certain changes. Enter your total buying price of all the cryptocurrencies.

Heres how to calculate tax if investing in cryptocurrencies and NFTs in India. It went on to hold that input tax credit on purchase of demo cars cannot be denied merely because such. Use our crypto tax calculator below to.

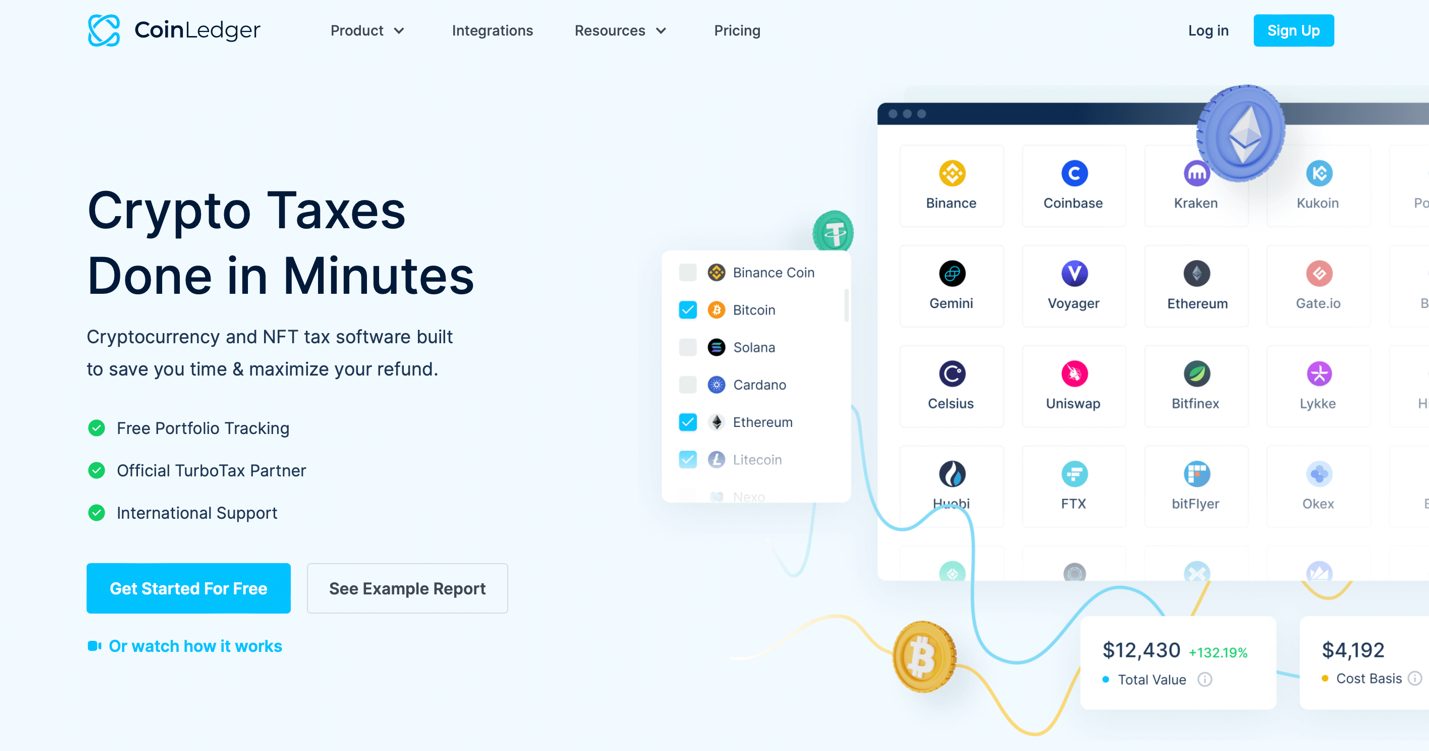

Following are the steps to use the above Cryptocurrency tax calculator for India. You made 1 lakh profit on Ethereum while you lost 50k on Bitcoin. Simply connect your accounts and let CoinLedger calculate your gains and losses across all of your transactions.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. In the budget 2022 new rules related to the taxation of cryptocurrencies have been introduced. Blox supports the majority of the crypto coins and guides you through your taxation process.

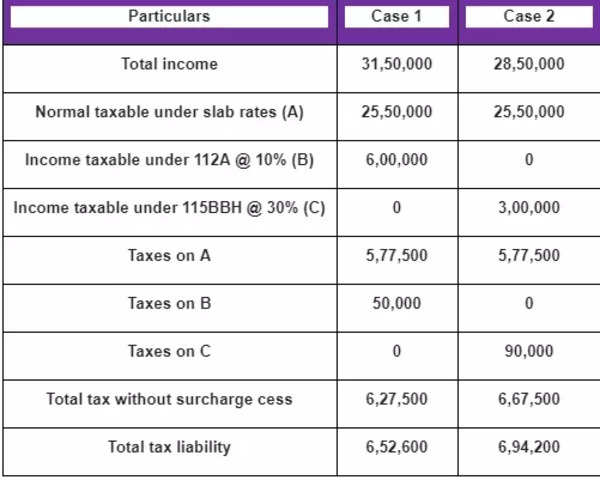

If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in. In the 2022 budget the Finance minister introduced Section 115BBH. Cryptocurrency Income Tax Calculation.

How To Use The India Cryptocurrency Tax Calculator. The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income. The cryptocurrency tax calculator tool therefore can be.

Cryptocurrency Tax Calculation 2022. Cryptocurrency and Income Tax Clarification on the taxation of cryptocurrency in India was highly awaited for the crypto holders. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

With the introduction of Budget 2022 the. This calculator is intended for use by US. For higher and additional rate taxpayers tax is charged at 20.

ITR that stands for Income Tax. The tax on cryptocurrencies introduced by the government of India has removed any ambiguity on its tax treatment. Enter the sale price of the asset and the assets purchase price.

It is kept at a flat 30 on income from the transfer of digital assets such as.

.jpg)

How To Report Cryptocurrency On Your Taxes In 5 Steps Coinledger

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Free Crypto Tax Calculator Crypto Tax In India Crypto Tax Explained India Youtube

Crypto India Tax Calculator Apps On Google Play

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

11 Best Crypto Tax Calculators To Check Out

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

11 Best Crypto Tax Calculators To Check Out

How To Calculate Tax On Cryptocurrency In India

Free Crypto Tax Calculator Coinledger

10 Best Crypto Tax Software In 2022 Top Selective Only

Koinly Review Our Thoughts Pros Cons 2022

Why Are Cryptocurrency Profits To Be Taxed At 30 In India Quora

Crypto Tax And Portfolio Software Cointracker

How To Disclose Cryptocurrency Gains While Filing Income Tax Return Mint

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

Binocs Cryptocurrency Tax In Us Cryptocurrency Tax Reporting Software Best Tool To Calculate Cryptocurrency Tax